On the 10th of July 2020, the Ministry of Economy and Finance (“MoEF”) issued Ministerial Order No. 563 (“MO 563“) which sets out the form, procedures and requirements for entities that are required to submit financial reports for an independent audit with an auditor who is a member of the Kampuchea Institute of Certified Public Accountants and Auditors (“KICPAA“) and licensed by the Accounting & Auditor Regulator (“ACAR”).

Who is required to submit financial reports for an independent audit?

All public enterprises, enterprises with public accountability, and investment projects/Qualified Investment Projects (QIP) must submit their financial reports for each accounting period for an independent audit.

In addition to the enterprises outlined above any enterprise in Cambodia that meets two (2) of the three (3) criteria as given below will also be required to submit their financial reports for independent audit for each accounting period.

- Annual Turnover: Above KHR 4 billion (approximately USD 1,000,000)

- Total Assets: Above KHR 3 billion (approximately USD 750,000) at the date of the close of the accounting period

- Number of Employees: More than 100 referring to the average number for the year

Enterprises that do not meet two (2) out of the three (3) criteria above can also voluntarily submit their financial reports for independent audit.

Not-for-profit entities must submit their financial reports for each accounting period for independent audit if the not-for-profit entity meets the criteria below:

- Total Annual Expenses: More than KHR 2 billion (approximately USD 500,000); and

- Number of Workers/employees: Twenty (20) or more individuals, referring to the average number of workers/employees for the year.

Not-for-profit entities that do not meet the two criteria above can voluntarily submit their financial reports for independent audit.

Responsibilities for entities that are obliged to submit their financial reports for independent Audit

Those categories of entity, as outlined above, that are obliged to submit their financial reports for independent audit are required to do so for a minimum of 3 (three) consecutive accounting years even if the entity ceases to meet the criteria.

If an entity, that was obliged to submit their financial reports for independent audit, ceases to have commercial activity or operations for a period of 12 (twelve) consecutive months from the close of its last accounting period, that entity can make a request to the Accounting & Auditing Regulator (ACAR) to not submit financial reports to independent audit.

The issuance of an independent audit report shall be completed no later than 6 (six) months from the closing date of the accounting period. In the case that this cannot be carried out, entities that are obliged to obtain an independent audit report can request an extension from the Accounting & Auditing Regulator (ACAR) with an appropriate explanation.

Entities who are obliged to obtain an audited financial report shall submit (online) the report to the Accounting & Auditing Regulator (ACAR) no less than six (6) months and fifteen (15) days from the closing date of their accounting period.

Auditors shall not provide audit services to an enterprise or not-for-profit entity for more than five (5) years consecutively.

Penalties

Without considering other criminal charges as set forth in the Law on Accounting and Audit and effective regulations in the fields of accounting and auditing in the Kingdom of Cambodia, entities subject to audit requirements that do not comply with the obligations as set out in Ministerial Order 563 shall be subject to fines from the Accounting & Auditing Regulator (ACAR) as set forth in Sub-Decree 79 SDMO dated 1st June 2020 or fines for violations of the Law on Accounting and Audit.

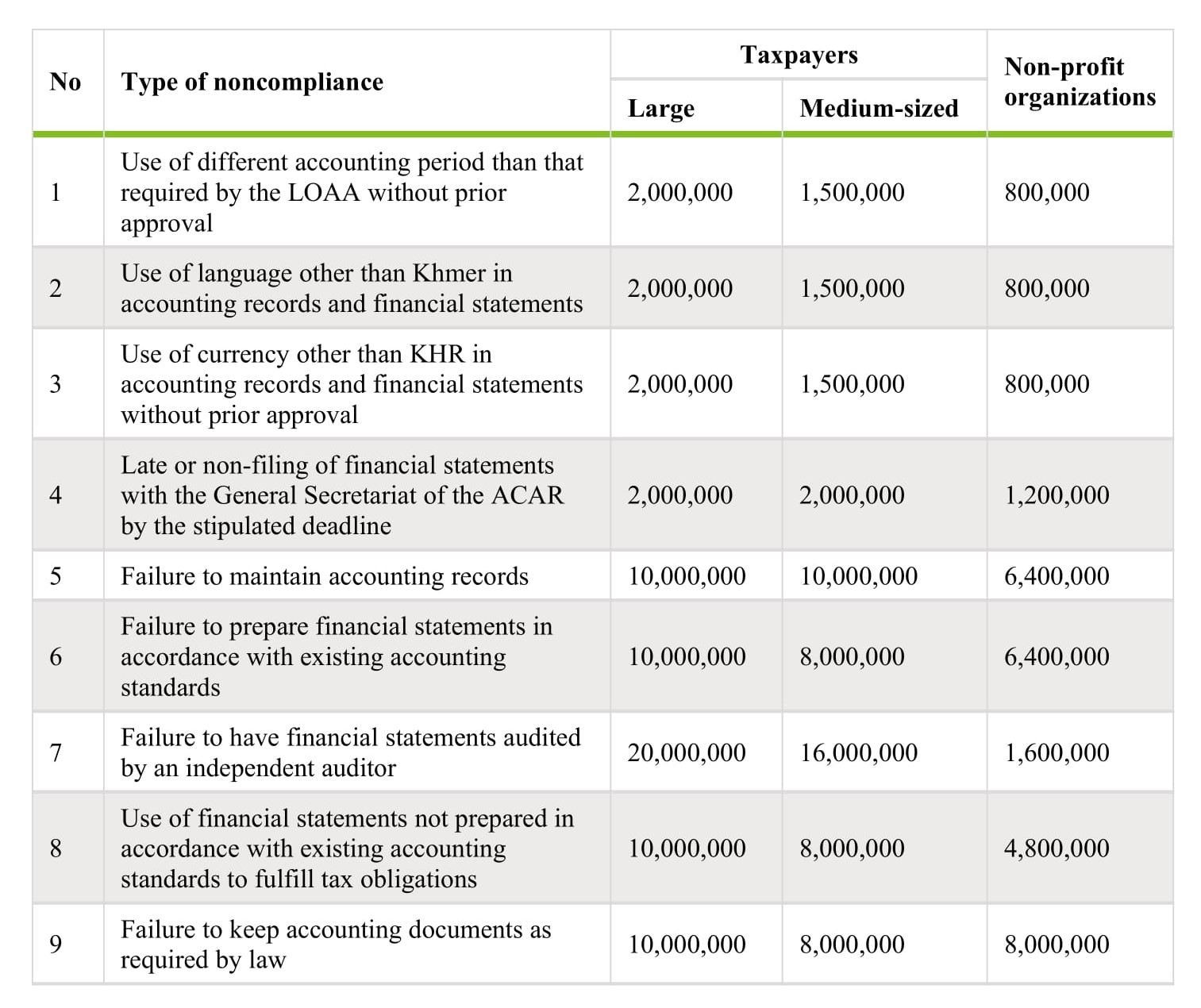

Punishment on violations of Accounting & Auditing Law:

The Royal Government of Cambodia issued a sub-decree on 1st June 2020 providing the penalties to be imposed for noncompliance with the Law on Accounting and Auditing (LOAA) (Sub-decree no. 79 RNKr.BK), effective immediately. The purpose of the sub-decree is to increase the responsibility of enterprises, non-profit organizations (NPOs), accountants, and auditors so as to ensure that the LOAA is implemented effectively.

The sub-decree covers the following:

- Enterprises and legal entities registered with the Ministry of Commerce and/or the General Department of Taxation as large or medium-sized taxpayers;

- All NPOs registered with relevant ministries and institutions; and

- All accountants and auditors who are members of the Kampuchea Institute of Certified Public Accountants and who have obtained a license to perform the accounting and auditing profession from the Accounting & Auditing Regulator (ACAR).

The tables below provide a summary of the penalties for various types of non-compliance (in KHR).

The late settlement of a penalty (i.e., as from the date the penalty notification is received) will be subject to the following additional penalty:

- Over 30 days: Penalty amount doubled.

- Over 60 days: Penalty amount tripled.

- Over 90 days: Legal action initiated by the ACAR.

Disclaimer

This document/material is not intended to provide definitive answers to specific individual/corporate circumstances and as such is not intended to be used as a guide. Invest in Cambodia recommends seeking independent expert advice relating directly to any specific situation. Invest in Cambodia accepts no responsibility for anyone placing sole reliance on this material.

About Us:

At Invest in Cambodia, we are dedicated to bridging the gap between global investors and the promising market of Cambodia. With years of experience and a deep understanding of the local business environment, our team of experts is committed to providing top-notch services to facilitate your business journey in Cambodia. Invest in Cambodia is an integral part of Delve Deep Co., Ltd.

Contact Us:

Email: info@investincambodia.asia

Phone:+855 (0) 98 228 907

Website: www.investincambodia.asia